Community Talks Tariffs and Trade at Latest Chamber Roundtable

On Tuesday, the Springfield Area Chamber of Commerce was pleased to welcome Chris Eyler, Vice President of Congressional and Public Affairs at the U.S. Chamber of Commerce, for a special Chamber Roundtable program: Washington Insights: A Briefing from the U.S. Chamber. The session offered a candid look at the national economic landscape and the issues poised to impact local businesses.

Despite persistent headwinds, Eyler noted that 2024 closed with economic resilience – strong growth, a steady job market, and signs that inflation was easing. But turning to 2025, the picture is less optimistic. Even as inflation shows signs of subsiding and employment numbers hold steady, the broader environment is fraught with uncertainty. Investors, businesses, and consumers alike are sitting on their hands, waiting for the economy to stabilize.

Tariffs, he emphasized, have created a significant drag on the economy, with rising costs on imported goods affecting so many manufacturers and small businesses; and the strain is especially heavy in trade-reliant states like Oregon. What’s more, the political environment in Washington, DC – with very slim majorities in both the House and Senate – will not likely be able to provide much legislative relief on critical economic policies.

Bright spot? Extending the TCJA

Eyler outlined several pressing items on the congressional to-do list, noting one potential bright spot in legislative affairs could be the extension of the Tax Cuts and Jobs Act (TCJA). Passed in 2017, many provisions of the TCJA were temporary. If allowed to expire, both business and personal tax rates will increase significantly (earlier this year, the Springfield Chamber signed a letter to Congress to make the TCJA permanent).

This issue is particularly urgent for Oregon, where pass-through businesses – those whose income is taxed at the personal rather than corporate level – make up more than half of all private sector employment, including sole proprietorships, partnerships, limited liability companies, and S-corporations.

The expiration of the 20% pass-through deduction could have devastating consequences for local small businesses. To help business owners understand what’s at stake, the U.S. Chamber has developed a tax increase calculator, illustrating the potential impact of TCJA expiration.

“Our biggest concern is the 20% pass-through deduction … this is our top priority for the year, to make sure deductions are extended before they expire. These deductions represent a $2.3-billion-dollar tax benefit to small businesses in Oregon. Many small businesses don’t even realize this is happening.”

– Chris Eyler, Vice President of Congressional and Public Affairs, U.S. Chamber of Commerce

The good news: according to Eyler, efforts to lobby Congress to extend the TCJA are generally moving in the right direction. The U.S. Chamber’s instructions to extend the legislation have reached the House of Representatives, and Speaker of the House Mike Johnson has set a deadline for this extension by Memorial Day, or latest, the Fourth of July.

Bad news on trade

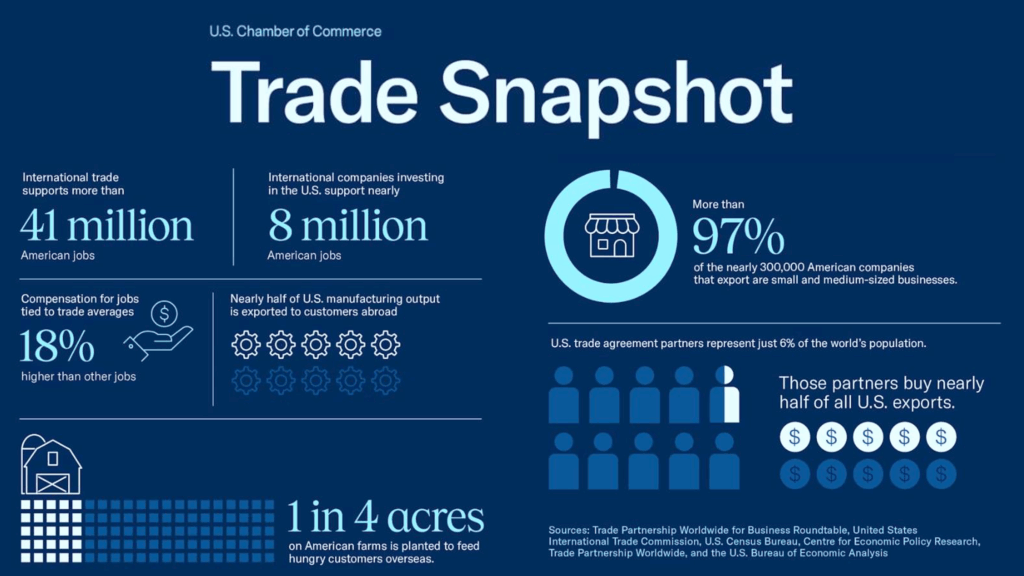

Trade policy also featured heavily in the discussion. Eyler was frank: the current approach is ineffective and untenable. Tariffs, he averred, are effectively taxes on American consumers – hurting not only household budgets but also the global competitiveness of American manufacturers.

Oregon, home to a robust machinery, tech, and transportation sector, is disproportionately affected by recent tariffs. And yet, tariffs remain in place even with allies and trade surplus partners like England and Australia. “No one, not even economists, understands the President’s end goal,” Eyler observed, noting the unpredictability of recent trade policy.

Q&A session

During the Q&A, attendees raised questions about the US Chamber’s role in the tariff conversation in Washington, DC – on everything from trade coalitions to the historical echoes of past tariff policy. Chris Eyler and the U.S. Chamber continue to advocate for business on Capitol Hill, working with members of Congress and international coalitions to highlight the real-world impacts on businesses. They are watching several lawsuits, including one from the State of California, that are challenging the administration’s use of emergency powers to impose tariffs.

The Springfield Chamber would like to thank Chris Eyler for visiting Springfield to keep the business community informed, and all the attendees that made this a robust and impactful dialogue. The Chamber will continue to monitor conversations and policies that are integral to health of business and industry in Oregon. Click here for more on our business advocacy efforts.

Tariff, Trade Survey

You are invited to complete this brief survey to collect Oregon business’ reactions to the current tariff and trade environment. All responses are anonymous. The survey is administered by the Oregon Business Development Department (Business Oregon), in collaboration with the Port of Portland and the Oregon Department of Agriculture. Data collected will create a better understanding of our current business environment as it pertains to trade and tariffs; the Springfield Chamber would like Lane County industry information to be reflected in the survey results.

More about the US Chamber

The Chamber of Commerce of the United States is the world’s largest business organization. Our members range from the small businesses and chambers of commerce across the country that support their communities, to the leading industry associations and global corporations that innovate and solve for the world’s challenges, to the emerging and fast-growing industries that are shaping the future. For all of the people across the businesses we represent, the U.S. Chamber of Commerce is a trusted advocate, partner, and network, helping them improve society and people’s lives.

Discover more from Springfield Bottom Line

Subscribe to get the latest posts sent to your email.