Chamber’s Small Business Solutions Hub Program Unravels Corporate Transparency Act

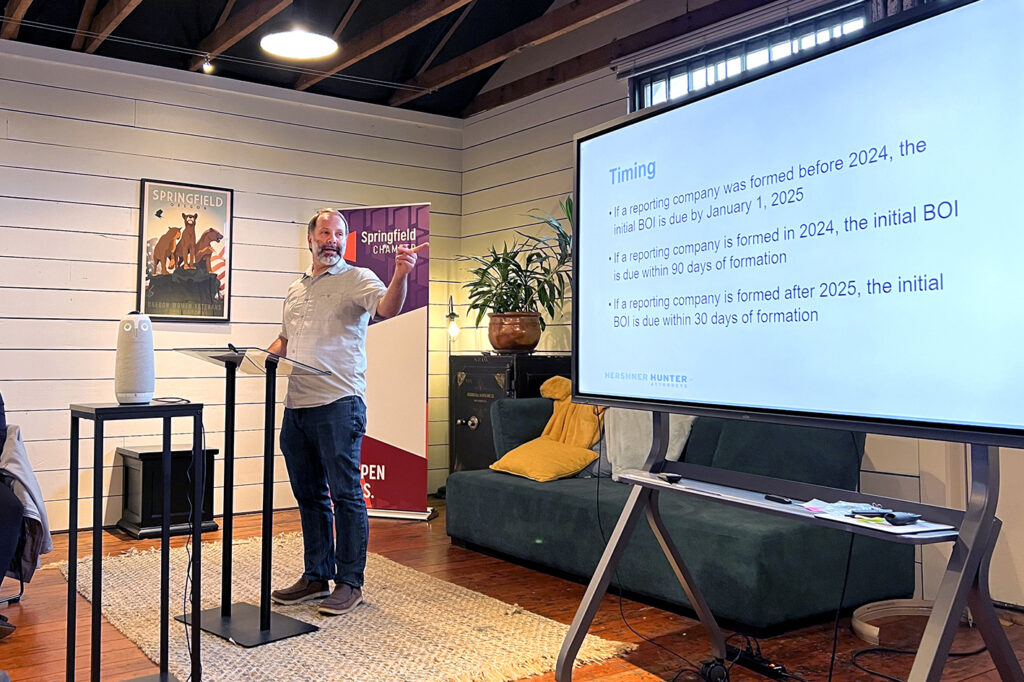

In January, 2024, the Springfield Area Chamber of Commerce put on their quarterly Small Business Solutions Hub program at the Chamber Depot in downtown Springfield. The Chamber brought in Pablo J. Valentine, a partner at Hershner Hunter, LLP, to talk about new reporting requirements for small businesses introduced by the Corporate Transparency Act.

Beginning January 1, 2024, many companies in the United States will have to report information about their “beneficial owners” – that is, the individuals who ultimately own or control the company. Companies will have to report the information to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury. Mr. Valentine was brought in to unravel the new legislation, which places a significant burden on the reporting businesses.

The Small Business Solutions Hub program began at 12:00pm, after a networking lunch. Following quick introductions by Paige Walters, the Chamber’s Director of Advocacy & Economic Development, and Colleen Lawson, a representative from the program’s title sponsor Kaiser Permanente, Mr. Valentine jumped right into the weeds of the Corporate Transparency Act, including:

- why the legislation was passed;

- which businesses need to report and which are exempt;

- the definition of a “beneficial owner”;

- the information that will need to be submitted by reporting companies.

Throughout the program, Mr. Valentine answered detailed questions, from those in organizations who maintain “substantial control” to the nuts and bolts of the Beneficial Ownership Information Report (BOIR). His 40-minute presentation was immediately followed more discussion in an informative Q&A.

Takeaways

As is typical with compliance issues, there will be a lot of changes to the federal requirements over the next year or so. The Springfield Chamber will add any new information to our Small Business Solutions page as it is received. Keep checking back to that page for updates.

It’s important to institute a method of flagging this issue and re-reporting two years, five years, 10 years down the road, as you will need to keep your organization in compliance every time your business information gets updated.

While this affects many small businesses, there are several exemptions to the Corporate Transparency Act reporting requirement. Get more information about exemptions as well as answers to other FAQs in our previous article in the Bottom Line, Corporate Transparency Act Adds New Federal Reporting Requirements for Many Small Businesses, which outlines the new requirements in detail.

Many thanks to our featured speaker: Pablo J. Valentine, Partner, Hershner Hunter, LLP.

The Chamber would also like to thank their Small Business Solutions Hub title sponsor, Kaiser Permanente, as well as their investors, Ask Erik Computer Services, Belfor Property Restoration, Chambers Construction, Eugene Area Radio Stations (EARS), Hershner Hunter, OCCU, and WaFd Bank.

Please enjoy the video of the full program embedded below; also available on the Small Business Solutions Digital Hub under the Springfield Chamber Resource Library.

Discover more from Springfield Bottom Line

Subscribe to get the latest posts sent to your email.