Springfield Chamber Will Oppose Measure 118, Joins Coalition to Fight November Ballot Measure

[UPDATE August 2, 2024] On August 1, the Oregon Secretary of State’s Office assigned a ballot measure number to the costly tax on sales formerly known as Initiative Petition 17 (IP17) that will appear on the November ballot – the initiative is now officially Measure 118. If passed by Oregon voters, Measure 118 would impose a 3% tax on businesses with gross Oregon sales over $25 million per year. The measure is essentially a gross receipts tax: It would tax sales, not profits – and businesses would be forced to pay the tax regardless of whether they were making a large profit, small profit, or were losing money. See more information below and join the coalition to defeat Measure 118.

The Springfield Area Chamber of Commerce will join a growing statewide coalition of concerned businesses, organizations, and individuals to fight a costly new sales tax on businesses and to educate the public on the facts and impacts ahead of the November election.

The Springfield Chamber has been closely tracking efforts to qualify Initiative Petition 17 for the November 2024 ballot with our partners at Oregon Business & Industry (OBI) and Oregon State Chamber of Commerce (OSCC).

It is crucial that business and community leaders understand the impact of this tax expansion on consumer prices, local business, and jobs, and are fully prepared to engage in efforts to oppose a measure on the November ballot.

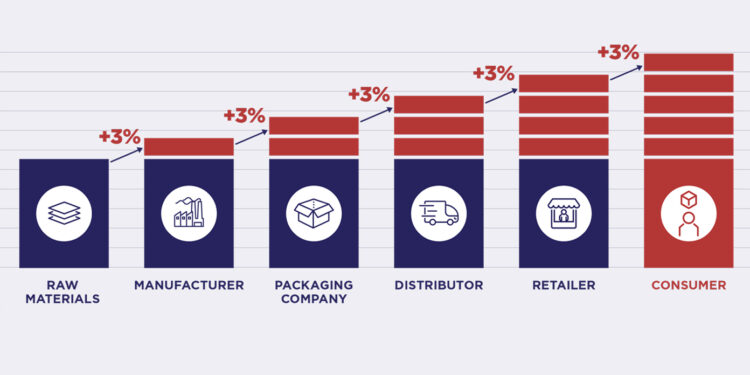

Measure 118 would modify Oregon’s corporate minimum tax structure by adding to the existing tax a new 3% tax on Oregon sales more than $25 million per year – in effect, making Oregon products more expensive, Oregon companies less competitive, and increasing prices on Oregon consumers.

Revenue raised from the new tax would go to a “rebate” program, wherein everyone living in Oregon for 200+ days, regardless of tax-paying status, would receive a payment of equal amount.

A gross receipts tax means that Oregon businesses would be forced to pay this new tax regardless of whether they make a large profit, small profit, or are losing money; and because the tax applies at every step of the production and selling process, it is far more costly than a typical sales tax.

We encourage our members and individuals to stay informed, join the coalition, and declare their opposition to this costly measure. Business owners and individuals can begin by submitting the coalition member form below:

The Springfield Chamber advocates for business-friendly policy in support of private enterprise, entrepreneurial endeavors, and an economically competitive business climate. We support a tax system that stimulates economic growth, avoids a disproportionate tax burden on select sectors of the economy, and provides rules and processes that are transparent. For more information, please visit the Business Advocacy page on the Chamber website.

Discover more from Springfield Bottom Line

Subscribe to get the latest posts sent to your email.