Insurance Options for Chamber Members

Introducing Springfield Area Chamber of Commerce’s CHAMBER HEALTH PLANS, in affiliation with the Bend Chamber of Commerce.

Looking for affordable healthcare for your employees?

Look no further than the Chamber Association Health Plans. With more than 850 groups enrolled across the state and covering over 15,000 lives, the plan options are continuing to grow and become more affordable than ever. In fact, our plans often cost 5%-15% less and have richer benefits than most small group plans in the marketplace.

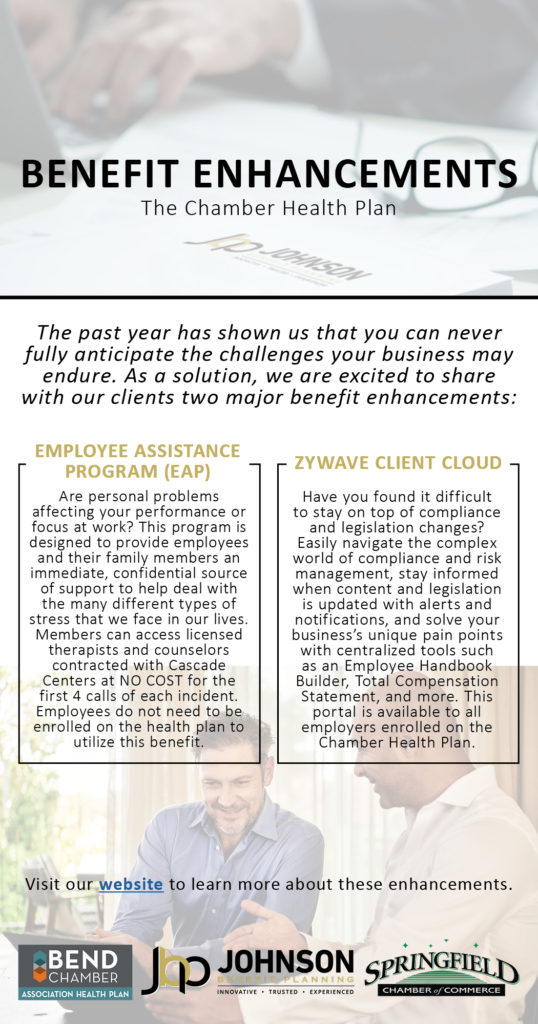

2021 Chamber Health Plan Benefit Enhancements

The Chamber Health Plan is administered through PacificSource Health Plans, a local insurance company that reinvests into the community of Springfield. The plans have strategically been designed on a large group platform, which allows for small businesses to access different benefits than they could with the traditional small group market plans available.

The Chamber Plans are the result of a partnership between the Chamber and PacificSource Health Plans to help our employers create resources and opportunities for members’ success, quality of life, engagement, and meaningful impact. We provide programs and resources to enhance achievement of our members’ organizational goals. 2020 showed us that you can never fully anticipate the challenges that businesses or members may endure, so the Chamber Health Plan added two extremely valuable services to their plans effective January 1, 2021. The first was Zywave’s Client Cloud, which is a one-stop resource for many Human Resource, Compliance, and safety needs; and the second was an Employee Assistance Program (EAP), which is a program that assists employees with personal and/or work-related problems that may impact their job performance, health, mental, and emotional well-being. The Chamber Health Plan also offers the following unique benefits:

- Many benefits are not subject to deductible

- $1,000 of accidental coverage – if treated for an accident within 90 days, the first $1,000 are covered at no cost to the member

- COBRA Continuation – small groups typically receive 9 months of state continuation, but the Chamber Plan offers 18 months of continued coverage

- COBRA Administration – usually a third-party administrator (TPA) is needed to administer COBRA which incurs a cost to the employer, however the Chamber Plan offers FREE COBRA Administration through PacificSource Administrators (PSA)

- Accidental Death – there is a $25,000 accidental death benefit for every member provided at no cost

The Chamber Health Plan offers affordable rates and benefits to qualifying Chamber Members, substantial savings, and a 12-month rate guarantee from enrollment date. The eligibility rules to qualify for the Chamber-sponsored Health Plan are a little different due to the nature of the plan, so it is highly recommended to speak with a specifically appointed broker to ensure that your company is a good fit for the plan:

- Backlund and Associates, LLC – 541-485-0881

- Boone Insurance Associates – 541-345-3707

- Great Basin Insurance – 541-343-8500

- KPD – 541-741-0550

- Oregon Insurance Company – 541-538-2700

- Johnson Benefit Planning – (541) 912-7536

- Ward Insurance – 541-687-1117

Discover more from Springfield Bottom Line

Subscribe to get the latest posts sent to your email.